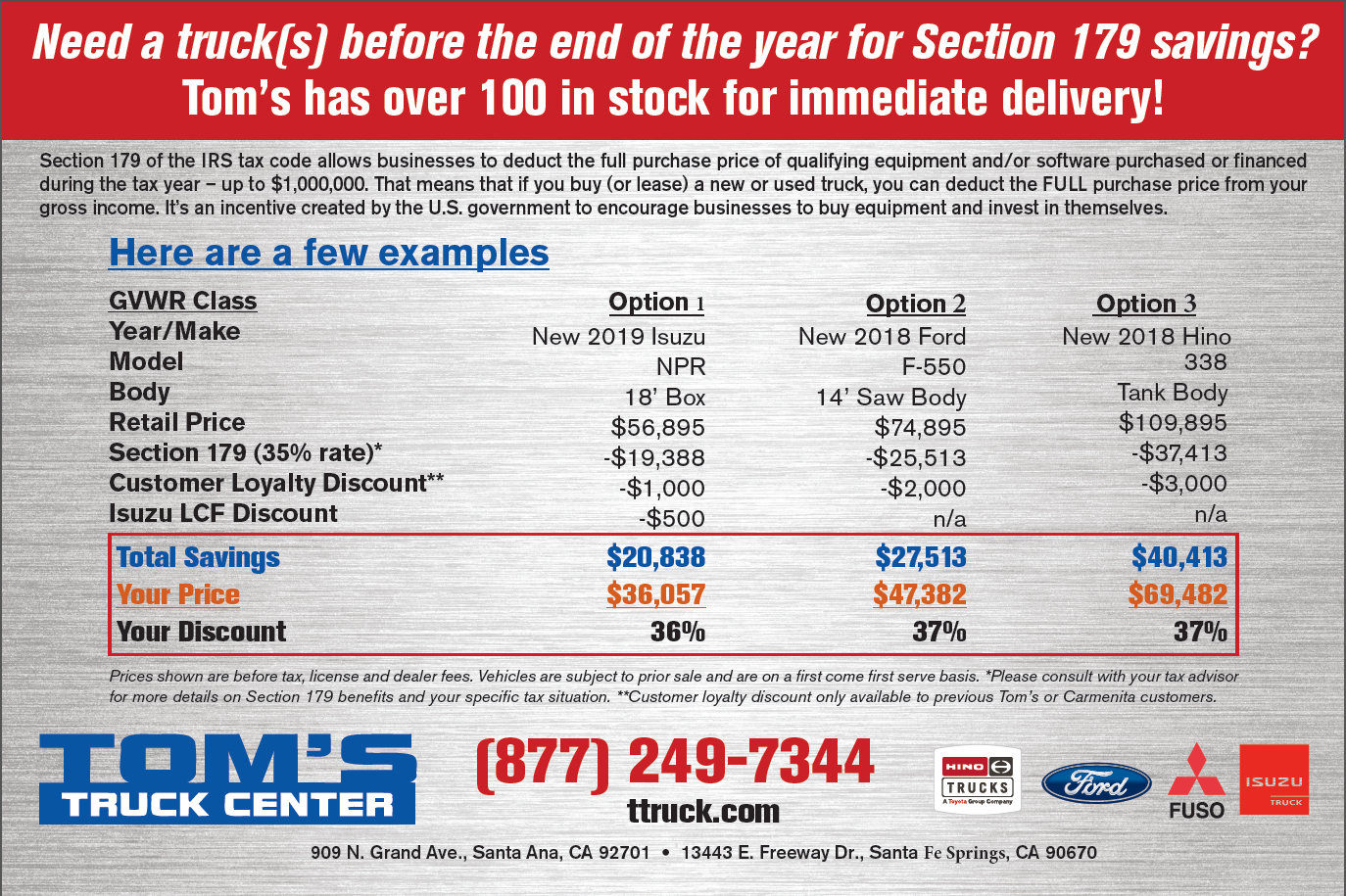

section 179 deduction 2025 vehicle list – Below is our annual guide to Tax Code Section 179 for self-employed options can keep a vehicle from qualifying, so do your homework! IMPORTANT: This is the list of 2025 models that qualify, . you need to prorate the deduction. If you happened to purchase the vehicle in a prior year and want to claim the Section 179 deduction, unfortunately, that is not permissible. To qualify for the .

section 179 deduction 2025 vehicle list Section 179 Deduction List for Vehicles in 2025 | Block Advisors: Section 179 is one of the more misunderstood parts of the US tax code. While many companies take advantage of the tax deduction for equipment purchases, a surprising number of US businesses do not. . Adding medical insurance to the investment portfolio not only provides health coverage but also allows an individual to avail themselves of tax benefits according to Section 80D of the Income Tax Act, .